Even in composing a title for this post, I was riddled with guilt for all the things I’ve said about timeshares in the past (see this.) But I’ve come to realize that, as I’ve thought about sharing our story, it’s one that I feel will give an explanation as to why it was a great deal for us. So while we are ecstatic about our purchase, and had a really good, respectful experience, we still don’t think it makes sense for most people.

Backstory: How We Got Here

Back in 2005, we bought our first timeshare, on the resale market. A few years earlier, we’d visited family at their resort,  Mystic Dunes in Orlando, Florida, and enjoyed their place and the amenities it offered. So, perusing Ebay, we found one for sale, a 3br/3ba lockoff (which means it is a 2br/2ba + 1br/1ba with connecting doors). The seller (a young couple, I sleuthed) was asking $100 and they would pay all of the closing fees. At the time, the annual fees (for maintenance, dues, taxes, etc) was $~1,400. When we looked on Expedia and Hilton websites, we found that to be less than what it would cost to rent. Our goal for the purchase was 1/ have a place to vacation at regularly, and 2/ a gift for extended family to use. The entire Diamond Resorts portfolio would be open to us, and we would have the ability to make it a 2wk stay by opting to just use the 1br/1ba. Based on this, it was a good financial decision for us. Since then, here’s how we’ve used it:

Mystic Dunes in Orlando, Florida, and enjoyed their place and the amenities it offered. So, perusing Ebay, we found one for sale, a 3br/3ba lockoff (which means it is a 2br/2ba + 1br/1ba with connecting doors). The seller (a young couple, I sleuthed) was asking $100 and they would pay all of the closing fees. At the time, the annual fees (for maintenance, dues, taxes, etc) was $~1,400. When we looked on Expedia and Hilton websites, we found that to be less than what it would cost to rent. Our goal for the purchase was 1/ have a place to vacation at regularly, and 2/ a gift for extended family to use. The entire Diamond Resorts portfolio would be open to us, and we would have the ability to make it a 2wk stay by opting to just use the 1br/1ba. Based on this, it was a good financial decision for us. Since then, here’s how we’ve used it:

- A stay at Mystic Dunes for a sister, her husband and kids

- Extended family stay (us, our kids, siblings and grandparets) at Mystic Dunes (we used a “banked” year, providing us 6 bedrooms and sleeping 22

- Exchanged for a birthday trip to Cabo Azul in San Jose del Cabo, MX

- Gifted a honeymoon week at Cabo Azul to our son and his wife

- Gifted a honeymoon week at Vidanta Mayan Palace in Riviera Maya, MX to our daughter and her husband

- A couple’s stay for us and friends at Vidanta Grand Luxxe in Riviera Maya, MX

Each stay returned many fond memories, and we couldn’t have done this any more economically than we did, with a (now) annual fee of ~$1,578!

Our Position on Timeshares

Despite this, whenever we have been asked our opinion on or recounted our history with timeshares, we’ve always told people 1/ don’t buy a timeshare, and 2/ if you do, buy on the resale market. The reason for this is that, for most people, timeshares are not a good financial investment. If you go into a retail timeshare purchase with the idea that you are making an “investment in your vacation future” that will grow over time, you are looking at it the wrong way. Like an automobile purchase, the moment you walk out the door, your asset will decrease in value. Why? Mostly because of the resale market – if you are solely looking for a vacation rental with options to stay at a variety of other places, you can get into a timeshare for less than $5,000 (assuming you are paying part of the closing costs and depending upon the location of your ‘home’ property). Realizing that many will pay upwards of $100,000 and finance that amount with a high interest rate, it’s caused a lot of financial stress, heartbreak and frankly a bad reputation for the industry (though, some nefarious timeshare companies don’t help the matter). At least on the resale market you’re effectively buying used, so you’re not absorbing the retail costs. And yes, you may not have all of the touted benefits of having bought retail, but for most people the cost benefit of those are negligible, as they were for us.

Our Experience on the Timeshare Presentation Circuit

For the past 5yrs, we’ve taken most offers by Diamond (and then, Hilton, after they purchased Diamond Resorts International) for a 4d/3nt hotel stay in return for a 90-minute presentation. The reason why is because we love to travel(!) and because we do the math: We would get 50-100,000 Hilton Honors points (valued at $250-$500, conservatively), a 3nt stay, and a $100 Visa gift card, at least. Even with a $149-$199 fee, we come out ahead, with only a 90-minute interruption to our holiday. When we go to the presentation, firstly, we are respectful – at the end of the day, they’re trying to do a job. We make it clear upfront that 1/ we have agreed to the allotted time (we show them a timer on our phone), 2/ we already are owners, purchased on the resale market, and don’t feel a need to upgrade, 3/ Stephanie is a Financial Advisor, Certified Financial Planner, and our family CFO – there’s not much you can show in terms of financials that will sway us. In every case, we spend more time talking about our travels than a discussion about purchasing. We’ve always been out in less than an hour. Until now.

What Happened?!

For this presentation, we chose Las Vegas as our destination – it was Stephanie’s birthday weekend, and so it would be a nice opportunity to stay a couple of extra days and work remotely. We had benefits from our Caesars Diamond status to cover a few meals and an additional night staying at Paris Hotel. To top it off, we also used a Free Night certificate from Marriott to stay at the Bellagio. For our time and attention, Hilton Grand Vacations offered us 100,000 Hilton Honors points and a $100 Visa gift certificate. We put the $149 fee on one of our Hilton Business cards from American Express and used the quarterly $50 credit to decrease our out-of-pocket to $99.

We arrived late on a Friday and used some of our Caesars Reward points for a dinner at Beijing Noodle No. 9 (delicious!), then walked around for a bit before heading back to our stay at the Hilton Grand Vacations on the Boulevard.

At our appointed hour the next day, we strode in, highly confident that we would be in and out in less than an hour. Our confidence was also buoyed by the fact that we’d just completed the purchases of homes in our (eventual) US homestead of Tennessee, and a vacation home in Playa Del Carmen. There was no way we would/could buy anymore real estate, right?

The Setup

We were introduced to Janice, who was very friendly and personable, but we would not be swayed by that! After the pleasantries, we made it clear our intent not to purchase, for all the reasons we’ve shared. Janice listened respectfully, asking reasonable questions along the way. At some point, we shared that one reason we’d not purchased retail was that we were never offered what we felt was a decent valuation of our existing timeshare. Janice clued in on this and brought over a colleague of hers, Amr.

Amr was extremely knowledgeable about HGVC properties, the process, and reasonably so about our Mystic Dunes property. To be honest, we were feeling a bit “sold to” and began to make preparations to leave (we were 2hrs in by this point). But then Amr came back with an interesting offer.

The Offer

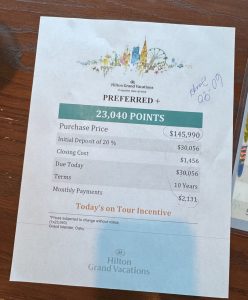

Initially, they presented an offer of 11,000 points for ~$100,000. There was no way we were going to pay that much – our  annual travel budget is ~$10,000 (airfare & lodging), so it would take 10yrs to recoup that money, not including the annual maintenance fees. And, the points would actually offer us less flexibility than what we had. They returned with an offer of 23,040 points, but we balked at the $145,990 price. They quickly came back with a discounted offer of $68,000 and an annual fee of ~$5,000. Again, not ideal – this was still 2 1/2 times our current annual fee.

annual travel budget is ~$10,000 (airfare & lodging), so it would take 10yrs to recoup that money, not including the annual maintenance fees. And, the points would actually offer us less flexibility than what we had. They returned with an offer of 23,040 points, but we balked at the $145,990 price. They quickly came back with a discounted offer of $68,000 and an annual fee of ~$5,000. Again, not ideal – this was still 2 1/2 times our current annual fee.

They asked what the sticking point was, and we shared that we like our current deed – it’s provided wonderful vacations for us and our family, and at a very reasonable annual cost. And, we don’t want to have multiple deeds/trusts to manage. So, the best thing for them to do would be to offer to buy our Deed and subtract that amount from the new trust.

Now we were getting somewhere. After some negotiating, they offered us $18,000 for our Deed. Based on the number of points required to stay in a Mystic Dunes 3br/3ba in our current week, annually, we felt it was worth closer to $22,000, and so we said no. Neither of us were budging but, it had been close to 4hrs by this time, and we were tired and I was getting anxious. So we agreed to call it a day; we would return tomorrow morning, so long as the deal we’d discussed would still be on the table, which they agreed to.

Team Huddle

Stephanie and I went back to our hotel and had a casual dinner in the restaurant (using another $50 Hilton credits, courtesy of our Amex Biz Plat!). We ran the numbers several times and agreed that we’d made the right choice to walk away. The only piece of data missing was this: how many nights and locations would we get for what they were asking. Up until this time, they hadn’t shown us any of the actual properties on the website itself. But, from a Facebook Group we were able to obtain a current year guide, so we had a general sense of the properties available. So we agreed to go back the next day with two objectives: 1/ peruse the actual HGV website and do our own assessment of what properties could reasonably be expected to have availability when we would want them, and at what points cost, and 2/ negotiate a lower price than the $68k. At this point, we were satisfied that if we didn’t like the deal, we would still walk away. But we were impressed by the willingness to be (a little?) transparent with us and listen respectfully to our questions and concerns.

objectives: 1/ peruse the actual HGV website and do our own assessment of what properties could reasonably be expected to have availability when we would want them, and at what points cost, and 2/ negotiate a lower price than the $68k. At this point, we were satisfied that if we didn’t like the deal, we would still walk away. But we were impressed by the willingness to be (a little?) transparent with us and listen respectfully to our questions and concerns.

Round Two

The next morning, we arrived and anticipated we would be done, one way or another in a couple of hours. That would not be the case. But, I’m getting ahead of myself. We started by re-establishing where we left off the day before, our budget & travel style, our current Deed ownership, and the numbers. They were insistent that they could not budge on either (“it wouldn’t be fair to other customers”), which I still think was baloney, but I let it go – we’d decided that if we could get $18k for our Deed, that would drop our out-of-pocket to $50k. Not an insignificant amount of money, but here is how we ran the numbers the night before:

If we can get (at least) $18,000 for our Deed, that drops the cost from $68,000 to $50,000. If we only look at our next 10yrs of travel, without adjusting for inflation, that would budget out to $100,000 + another $18,000 in annual fees on our deed, for a total of $118,000. If we take this offer, over the same 10yr period, we would spend $50,000 + $60,000 in annual fees, for a total of $110,000. And, the $50,000 is a fixed cost – we’ll pay that upfront, which saves us the 2-3% inflation hit every year. After the 10th year, we would be saving money on vacations where our lodging came through our timeshare, assuming we could get 2-4wks per year.

How Hard Can It Be To See Your Inventory?!

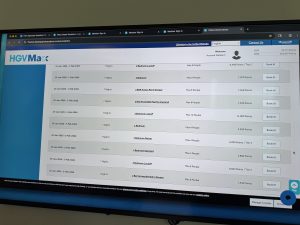

This left us with the need to actually peruse their live website (which you cannot do without being an owner) and run some theoreticals  based on the places we would want to go, the types of accommodations we’d want, and their availability for when we would want to travel. Thinking back, I’m still amazed at the level of effort (time, people and frustration) it took to get there – no one seemed to be either willing or able to drop out of their blasted app, drop into a browser, and log i

based on the places we would want to go, the types of accommodations we’d want, and their availability for when we would want to travel. Thinking back, I’m still amazed at the level of effort (time, people and frustration) it took to get there – no one seemed to be either willing or able to drop out of their blasted app, drop into a browser, and log i nto the website owners use. It literally took over an hour before they agreed too, walking away in a bit of frustration themselves, so that Stephanie and I could do some investigating. After about 45 minutes of planning out several 2026/27 vacation ideas, we came away satisfied: with the quantity of points we were being offered, we could reasonably expect to stay 4-6wks atlocations + accommodations we would want, at the time of year we would prefer. And, with a bit of flexibility, we could extend this out to close to 10wks! We were convinced that this would be a good deal, at least for us (I’ll keep saying that).

nto the website owners use. It literally took over an hour before they agreed too, walking away in a bit of frustration themselves, so that Stephanie and I could do some investigating. After about 45 minutes of planning out several 2026/27 vacation ideas, we came away satisfied: with the quantity of points we were being offered, we could reasonably expect to stay 4-6wks atlocations + accommodations we would want, at the time of year we would prefer. And, with a bit of flexibility, we could extend this out to close to 10wks! We were convinced that this would be a good deal, at least for us (I’ll keep saying that).

Icing on the Cake

Like I mentioned from the outset, we were really appreciative of the professionalism of Janice and Amr. Yes, they are salespeople. But they are also people. We truly believe that, if you treat people with kindness and eschew stereotypes and assumptions, you can surprise yourself at the difference it makes in your own experience. This was our case.

We tried again to get some wiggle room on both the downpayment and the credit for our Deed, but they wouldn’t budge. But, they did offer us a hotel+airfare vacation that put the retail value at $10,000 (I would say real world, closer to $4,000). We chose a 7n cruise + airfare, which we plan to take in 2026.

We have worked hard to have no short-term debt. And, the mortgages we do have are on real estate that has appreciated to the point that they are truly assets. We put everything we can on credit cards, paying them before we accrue interest or penalties. Still, we had just completed purchases of 2 homes in the previous 6 months, so we (I!) weren’t thrilled with the idea of writing a $50,000 check on a vacation I’d intended to spend less than $100 out-of-pocket! They offered us a novel deal: because they are part of Hilton, and Hilton has an affiliation with American Express, if we applied for and were approved for a Hilton Honors credit card by American Express, we could charge the $50,000 and get 0% interest for the first 12 months. Additionally, we would receive 130,000 Hilton Honors points (which I value at $650). If we split the payment between two cards (one each), we’d increase the points to 260,000 and Stephanie’s savvy investment skills could make a nice return on the $50,000 before we had to pay the card off next year. This sealed the deal for us.

Bump on the Road

We were both highly confident of being approved for the Hilton Honors credits cards. Stephanie went first (they have a PC set up specifically for signing up for the offer and getting the 0% financing), and was approved immediately with a temporary card number to us. I, on the other hand, was initially not approved. A quick phone call confirmed what I expected: I already had a Hilton Honors card, and they wouldn’t approve a 2nd one. The resolution would be to cancel the card I have and they would re-run the approval through. Great. I cancelled the card right then on the phone…only to be told that they couldn’t give me an approval immediately (arghhhh!). So, assured that I would get the card, we put 50% of the downpayment on Stephanie’s new Hilton Honors credit card, and 50% on my American Express platinum. For our troubles, Amr deposited 75,000 Hilton Honors points to my account on the spot.

HGV = DMV

I won’t bore you with the play-by-play, but the paper process took HOURS. We were told it was because they don’t get deed transfers very often, but getting updates every 15 minutes that “it will just be a little longer” got tiring. We busied ourselves by packing our pockets with the snacks from their snack bar (“that will teach them”!) 😀

When Amr learned that it was Stephanie’s birthday, he gifted her 2 $100 Visa Gift Cards! Again, something we didn’t expect, but showed an appreciation of our purchase. Janice also sent us $50, which was also totally unexpected, but we know we have a friend in Las Vegas now.

When we were finally able to meet with Finance, the process was relatively straightforward – a lot of signing, a Notary was involved, and I was given a form that, upon getting my Hilton Honors card, I could call them and they would cancel the charge on the American Express Platinum and charge it to the Hilton Honors card (note: it worked!).

Final Tally

Let’s start with our purchase: we now have a HGV Trust that gives us access to their entire portfolio, including the Diamond Resorts International properties we could access before. And we have access to their Exchange program as well. The $22,000  points more than doubles the weeks we have available to us, and after 10yrs we will be cost neutral against our current travel budget. Our Ramp Up and Go Years will now involve splitting our time between homes in Mexico and Tennessee, then using our timeshare and the balance of our travel budget for 4-6mos of travel in Europe and Asia. They also upgraded our status in their HGVMax program to Platinum from Gold for a period of time (6mos?) which we felt was of nominal value for us.

points more than doubles the weeks we have available to us, and after 10yrs we will be cost neutral against our current travel budget. Our Ramp Up and Go Years will now involve splitting our time between homes in Mexico and Tennessee, then using our timeshare and the balance of our travel budget for 4-6mos of travel in Europe and Asia. They also upgraded our status in their HGVMax program to Platinum from Gold for a period of time (6mos?) which we felt was of nominal value for us.

Additionally, we walked away with $300 in Visa gift cards, Stephanie received 130,000 Hilton Honors points (plus an additional 23,000 for her spend), and I received 100,000 for the presentation, 75,000 for the inconvenience with the approval, 130,000 sign up bonus, and 23,000 for the spend. The total Hilton Honors points between our two cards is 461,000, which I value at $2,300. Finally, we have a package for an airfare+lodging trip to one of several Hilton properties, which we value conservatively at $4,000.

Do as we say, not as we do

It is with both hesitancy and humility that I’m sharing the financials of the transaction and our lifestyle. But it’s the only way I believe we can provide the context in which we decided this was a good decision for us. We are committed to travel, committed to being debt-free, and committed to our budget. We’re able to pay the cost of the timeshare with no negative impact to our short or long-term financial plans, and the annual maintenance fees will be absorbed by our travel budget. If, after 10 years, we decide the timeshare no longer fits our travel lifestyle, walking away for the expense of closing costs would still put us ahead.

We hope this exhaustive detail is helpful to others, seeking insights into the timeshare process. And we’d like to think that sharing our own decision process will give others pause to consider how this impacts their financial and travel lifestyles.

We will make a video on our YouTube channel to go into more candor. Your comments and questions are always welcome.

Leave a reply

You must be logged in to post a comment.